Automating Compliance Reporting with AI-Powered Document Processing: Unlocking Accuracy and Efficiency in Regulated Industries

For professionals entrenched in compliance, operations, finance, or IT within regulated businesses, the daily battle is all too familiar. Mountains of documents—contracts, invoices, regulatory filings—must be meticulously reviewed, data painstakingly extracted, and reports painstakingly compiled to satisfy demanding regulatory standards. The heavy toll? Countless hours lost to manual data entry, rampant errors silently creeping into reports, and escalating costs that strain tight budgets. Each mistake or delay risks costly penalties, reputational damage, and endless rounds of rework.

The frustration is palpable: you know your team could be focusing on higher-value tasks, but instead, they’re drowning in repetitive, rule-bound work. You’ve tried improving workflows or training staff, yet the pressure of regulatory compliance never eases—and the risks persist.

But what if the tedious work of compliance reporting, the very bottleneck that weighs down your business, could be transformed? What if you could harness cutting-edge technology to automate document processing, drastically reducing manual effort and mistakes, while creating audit-ready reports ready at the push of a button?

This is the promise of AI-powered document processing.

The Hidden Struggles of Manual Compliance Reporting

Manual compliance reporting in regulated industries isn’t just slow. It’s fraught with risks:

- Endless data extraction from diverse documents. Different formats, handwritten notes, scanned images, and non-standardized forms mean staff spend hours deciphering and inputting data.

- High error rates. Fatigue from repetitive tasks leads to typos, missed fields, inconsistent records, and incomplete reports.

- Difficulty keeping pace with regulatory changes. New requirements demand rapid updates in reporting processes, requiring constant retraining.

- Opaque audit trails. Manually tracking who changed what and when can be impossible, complicating audits and investigations.

- Excessive costs and resource drain. Time-intensive reporting pulls staff away from strategic work, while costly mistakes jeopardize compliance and incur fines.

The result? A compliance process that’s reactive, fragile, and unsustainable as your documents and regulatory demands multiply.

A New Approach: AI-Powered Document Processing

The fusion of Artificial Intelligence technologies—optical character recognition (OCR), natural language processing (NLP), and robotic process automation (RPA)—can be a transformative force in compliance reporting.

Here’s how these technologies work in concert:

- OCR converts scanned invoices, contracts, and forms into machine-readable text, regardless of format or handwriting. Advanced AI-powered OCR adapts to document variations, improving accuracy where traditional OCR fails.

- NLP extracts and understands relevant information from unstructured text. Beyond mere data capture, NLP interprets the context of terms, clauses, and compliance indicators, enabling smarter data classification.

- RPA automates repetitive tasks such as data validation, aggregation, report generation, and distribution. Robots mimic human actions but work tirelessly without errors, around the clock.

Together, they streamline compliance reporting from start to finish—capturing data from diverse documents, verifying completeness and accuracy automatically, assembling audit-ready reports, and delivering them to stakeholders without a single keystroke.

Step-by-Step Framework to Implement AI-Powered Compliance Reporting

For businesses eager to break free from manual compliance drudgery, here is a practical implementation roadmap:

1. Document Inventory and Assessment

Start by cataloging all document types involved in your compliance process. Identify formats, data fields, volume, and current pain points. Understanding document complexity guides your AI selection.

2. Choose Suitable AI Tools

Evaluate AI OCR engines for accuracy with your document types. Pair them with NLP libraries that specialize in regulatory language processing. Select RPA platforms capable of integrating with your existing systems (ERP, CRM, compliance management).

3. Pilot Integration and Training

Run a pilot on a subset of compliance reports. Train AI models with sample documents for better recognition and extraction. Refine NLP rules to capture domain-specific information reliably. Develop RPA scripts to automate report generation workflows.

4. Validate Automation Accuracy

Put automated outputs through rigorous validation against manual results. Involve compliance and audit teams early to establish trust and compliance with regulations.

5. Scale and Monitor

Roll out automation across broader reporting activities. Continuously monitor AI performance and retrain models as regulatory language or document formats evolve. Maintain dashboards tracking exceptions requiring human review.

6. Secure Data and Maintain Audit Trails

Implement strict encryption, access controls, and immutable logs. Ensure every data extraction, modification, and report generation is traceable to uphold audit integrity and data protection standards.

Leading AI Tools for Compliance Reporting

Several market-leading AI tools can be combined effectively for compliance automation:

- Google Cloud Document AI: Offers powerful OCR/NLP tailored for regulatory documents.

- Microsoft Azure AI Document Intelligence: Excels in extracting structured data from invoices and contracts.

- UiPath and Blue Prism: Leading RPA platforms that integrate seamlessly with AI services to automate workflows.

- ABBYY FlexiCapture: Specializes in complex document processing with audit-ready reporting features.

Selecting the right tools depends on document complexity, existing tech infrastructure, and regulatory requirements.

Best Practices for Data Security and Auditability

Automating compliance does not mean compromising security or transparency. Excellence in this space demands:

- Data encryption in transit and at rest to guard sensitive information.

- Role-based access controls that restrict document and data handling according to job functions.

- Comprehensive, immutable audit logs that chronicle every action from AI data extraction to RPA-generated reports.

- Regular security audits and compliance checks to adapt to emerging threats and regulatory updates.

- Human-in-the-loop frameworks ensuring complex exceptions receive expert oversight.

This holistic approach alleviates concerns around AI errors, data breaches, or compliance lapses.

Real-World Impact: Time and Cost Savings

While specific figures vary by company, numerous organizations have reported transformative benefits:

- Risk mitigation by reducing human error.

- A cut in time spent on data extraction and report compilation.

- Reallocation of compliance staff to proactive risk management and strategic initiatives.

- Significant cost savings in reducing overtime and costly regulatory penalties.

The return on investment is not just dollars—it’s regained confidence and operational resilience in managing compliance.

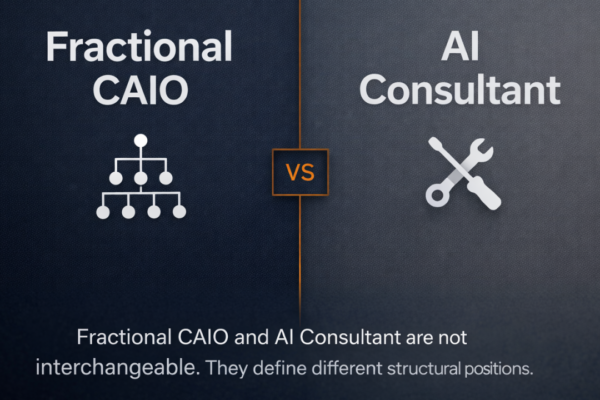

Why Partnering with Experts Matters

Implementing AI-powered compliance automation is complex—requiring domain knowledge in compliance, AI, and secure IT architecture. Missteps can lead to wasted budgets, failed audits, or business disruptions.

This is where experienced partners provide critical advantage.

MyMobileLyfe specializes in helping regulated businesses unlock the power of AI, automation, and data analytics to improve productivity and reduce costs. Their tailored approach ensures the right AI tools are integrated seamlessly with existing workflows, accounting for regulatory nuances, data security, and audit requirements.

By leveraging MyMobileLyfe’s expertise, compliance officers, operations managers, finance leaders, and IT decision-makers can confidently automate document processing and reporting—turning compliance from a relentless burden into a competitive advantage.

The exhausting grind of manual compliance reporting need not be your reality. Through AI-powered document processing, your business can reclaim time, reduce risk, and gain unprecedented clarity and control over regulatory demands.

Visit MyMobileLyfe today to explore how their AI and automation solutions can empower your compliance operations—helping your business not just survive regulations, but thrive within them.

Recent Comments